PSU-AAUP’s Response to University Leadership’s Assessment of the Bunsis Report

27 January 2025

Introduction

In November, the Board of Trustees tasked the administration with assessing the report by Professor Howard Bunsis on the financial condition of the university. That assessment was delivered to the Board in mid-January, and the Board attached its own commentary and released the assessment to the campus community on 23 January. What follows is PSU-AAUP’s rebuttal challenging the Board’s and the administration’s continued exceedingly pessimistic portrayal of the University’s financial condition.

We identify discrepancies between the University’s financial narrative and its actual fiscal health, highlighting the stark contrast between the Board’s claims of financial distress and the simultaneous approval of an $85 million dormitory construction project. After considering fund accounting practices, reserve management, and financial trends, we continue to agree with Professor Bunsis that PSU’s overall financial position remains solid, with increasing net assets, reserves exceeding debt, and a Primary Reserve Ratio above the Board’s aspirational level. We believe that the administration’s selective use of financial data and crisis narrative serves to justify austerity measures and faculty layoffs, while masking the University’s true fiscal reality and potentially undermining its core academic mission.

PSU’s Financial Position

It is striking that the Board chose to begin its response to the Bunsis Report by dismissing the Report’s conclusion that PSU is in a solid financial position as “misleading and unsupported.” The very next day, at a meeting of the full Board, the Trustees approved a motion to commence an $85 million dormitory construction project. University leadership has stated that the project will use debt financing, the issuance of bonds in particular. What sort of interest will the University have to pay on this debt when potential investors are being told by the university’s own Board of Trustees that the institution is not in a solid financial position?

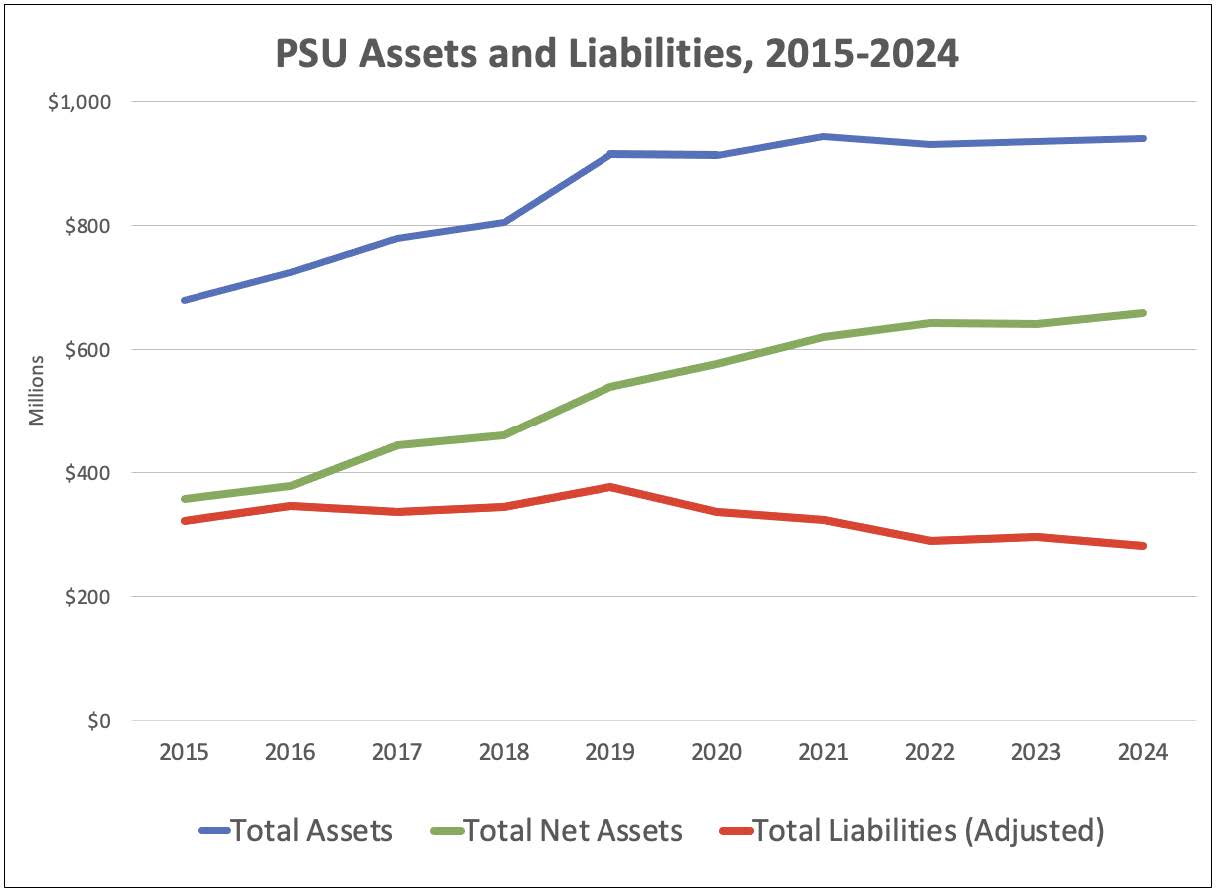

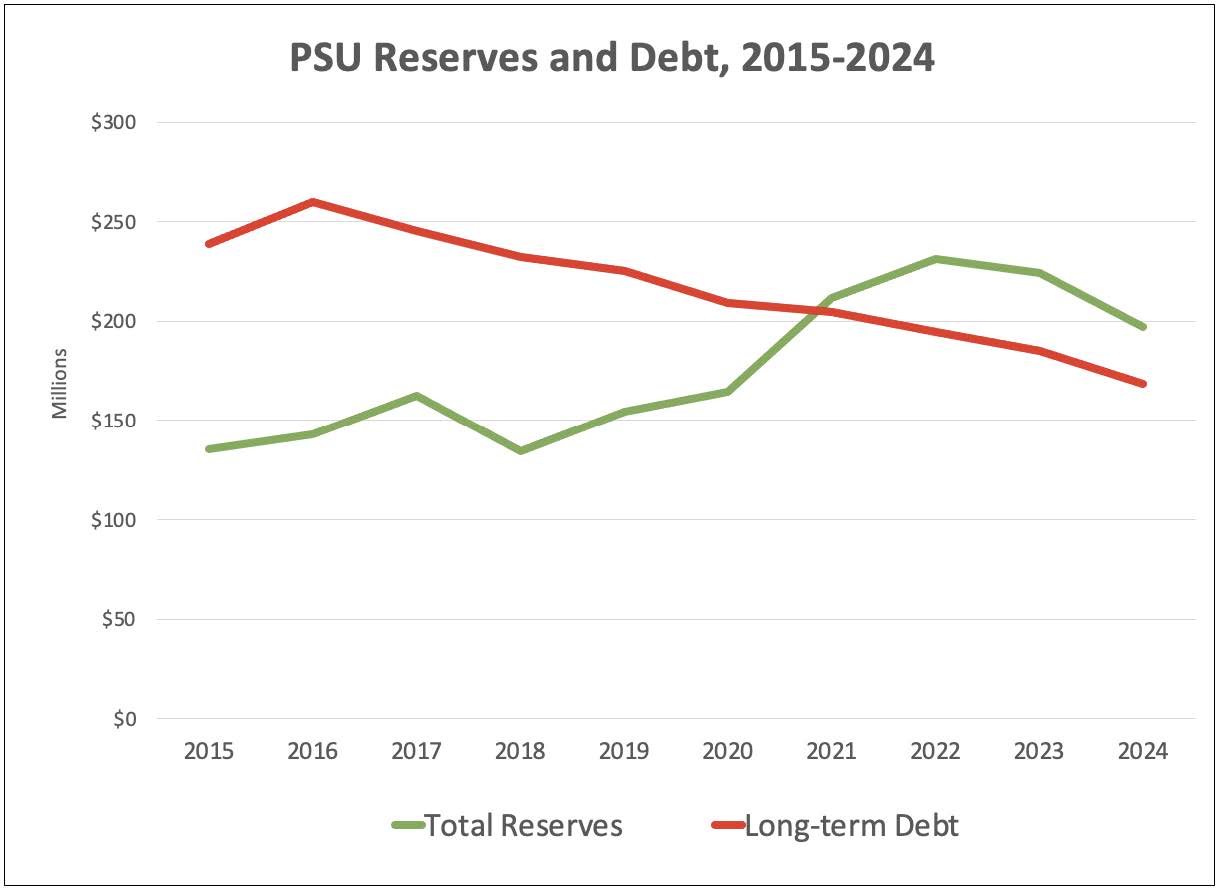

As a reminder, among the Bunsis Report’s indicators of PSU’s solid financial position -- updated below with data from the University’s just-released audited financial report for FY 2024 -- are a continuing increase in net assets (chart on the left) and reserves in excess of debt (chart of the right). If the administration and the Board are concerned by the narrowing of the latter in FY 2024, rather than attempting to shore up reserves by laying off faculty, how about a pause on taking on new debt associated with capital projects?

To acknowledge, as we all must, that PSU is running a budget deficit is not to affirm that the University faces a financial or even a budgetary crisis. That is the central lesson of the Bunsis Report. Yet it is this crisis narrative that the Board and the administration constantly offer as justification for faculty layoffs and other austerity measures. Case in point, also from the Board’s response to Professor Bunsis’s analysis: “The projected $18 million budget deficit for the current year is projected to reduce our E&G reserves to $79.4 million…. If we continue to draw on our reserves at this rate in future years, our E&G reserves will be completely depleted in less than five years.” Literally no one – and certainly not Professor Bunsis or PSU-AAUP – is advocating this. It’s a straw man.

What we and so many others are saying is that excessive cost cutting, including layoffs, are being imposed hurriedly and without strategic guidance. The President’s repeated assertion that, to paraphrase, “the contract made me do it” is disingenuous. The contract does not prevent, but rather mandates a deliberative, shared-governance approach to program revitalization. The upheaval we are now experiencing on this campus is not what the contract requires; it is the result of choices made by the Board and administration.

PSU’s Financial Reserves

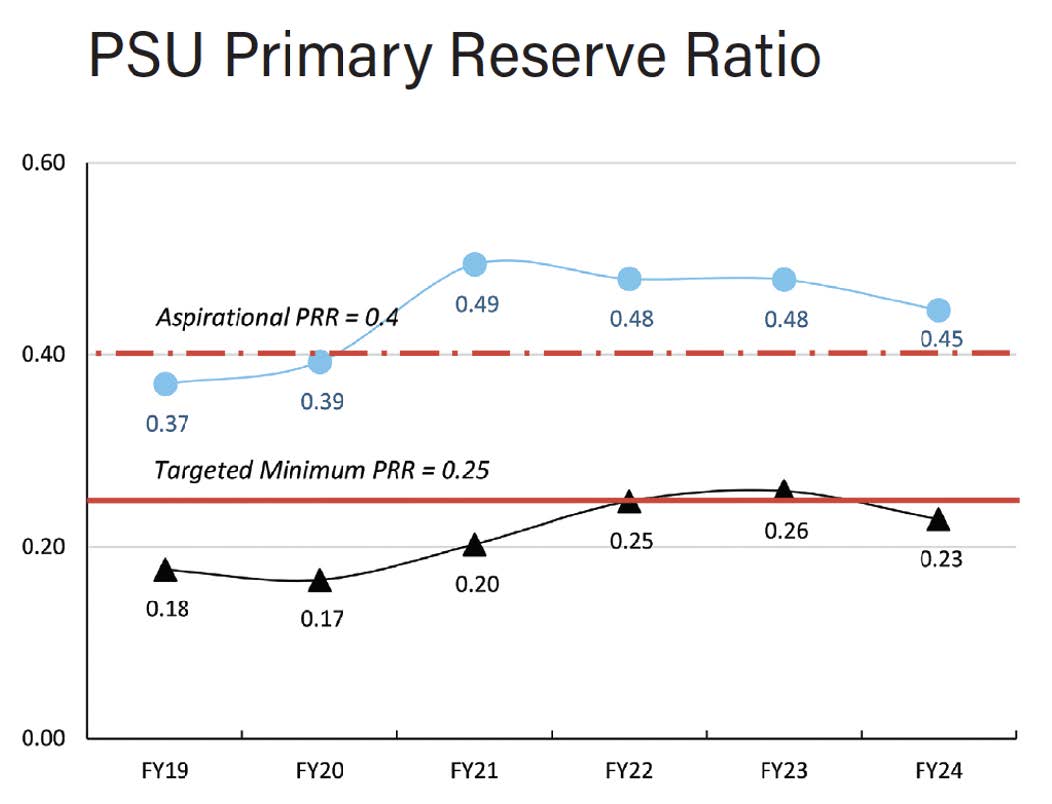

The Board’s Reserves Management Policy is also commonly invoked as if to absolve University leaders of responsibility for their financial choices. Let’s recall the trend in the University’s Primary Reserve Ratio (PRR) as reported in its 2024 Financial Profile. This indicator of “the financial strength of the university” is the ratio of expendable net assets to total expenses. The ratio is the proportion of a calendar year that University operations could continue if revenue suddenly dropped to zero.

The blue line with circles plots the PRR excluding liabilities associated with pensions and other post-employment benefits, while the black line with triangles plots PRR with those liabilities included. The Board’s reserve policy is that the first of these PRRs should be at least 0.25 – i.e., sufficient to cover three months of University operations in the absence of any revenue. As yet another indicator of PSU’s solid financial position, not only is the PRR above the Board minimum, but it is also above the “aspirational” level of 0.4.

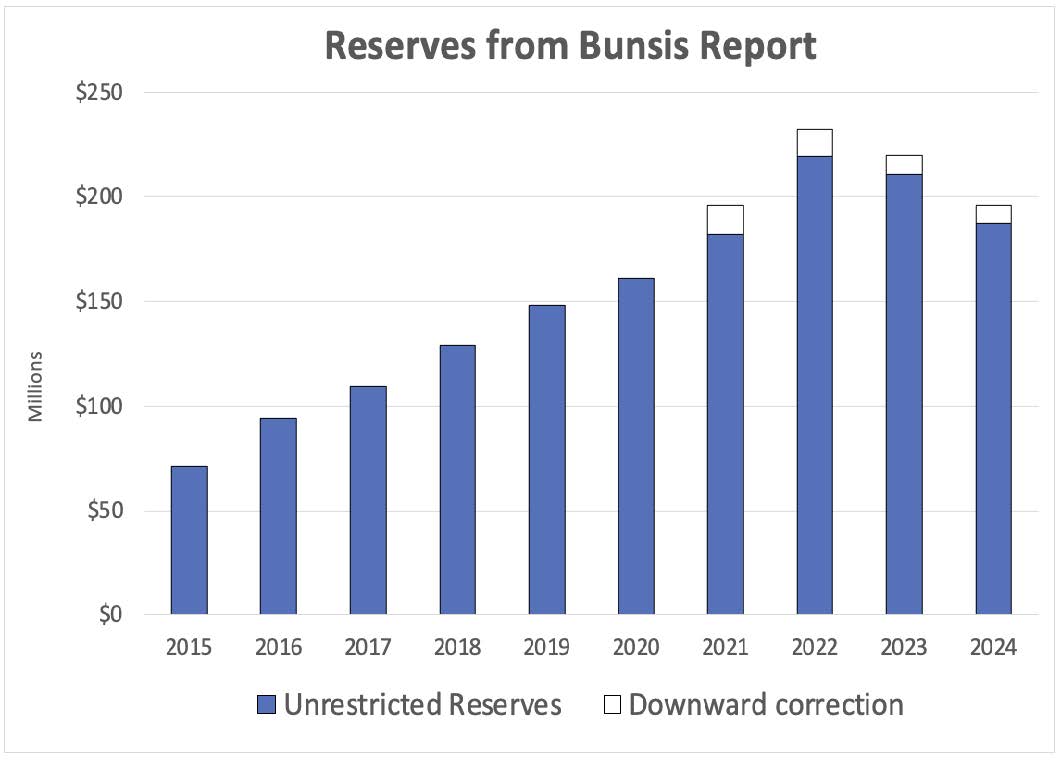

PSU’s Finance and Administration (FADM) team affirms Professor Bunsis’s calculation of the University’s reserves, with one correction: that deferred inflows from leases should not be included. Here, then, is a revised and updated presentation of the Bunsis calculations showing the effect of excluding leases receivable as reported in the University’s statements of net position (note: they do not appear before 2021). The Bunsis calculation and FADM’s calculation, as reported in their response to the Bunsis Report, are in alignment: at the end of FY 2024, the University’s reserves stood at $185 million.

The financial crisis narrative derives from the University’s “fund accounting,” which FADM explains in their response. It’s a way to track revenue and expenses by their intended purposes. The Education and General (E&G) fund is the largest of the separate funds and is associated with the University’s primary educational purpose. It is the reserves in this fund that are expected to drop below the Board-mandated minimum PRR of 0.25 by the end of the current fiscal year. And this, according to the Board, means PSU is not in a solid financial position -- despite the institution’s many other indicators of financial health, as relayed in the Bunsis Report and the University’s own Financial Profile.

How does a University-wide PRR comfortably above the Board’s aspirational level of 0.4, once the institution’s assets and liabilities are, for tracking purposes, apportioned among the several component funds, result in an E&G reserve balance teetering on the edge of the Board’s required minimum of 0.25? We’re sure that FADM could explain the accounting, but it will beg a second question: In what world does E&G revenue drop to zero and force the use of E&G assets to cover E&G liabilities while it’s business as usual for the rest of the institution, including the Foundation? There is no such world, and that is why the Bunsis Report examines the financial health of the University as an integrated whole and not a collection of financial fiefdoms.

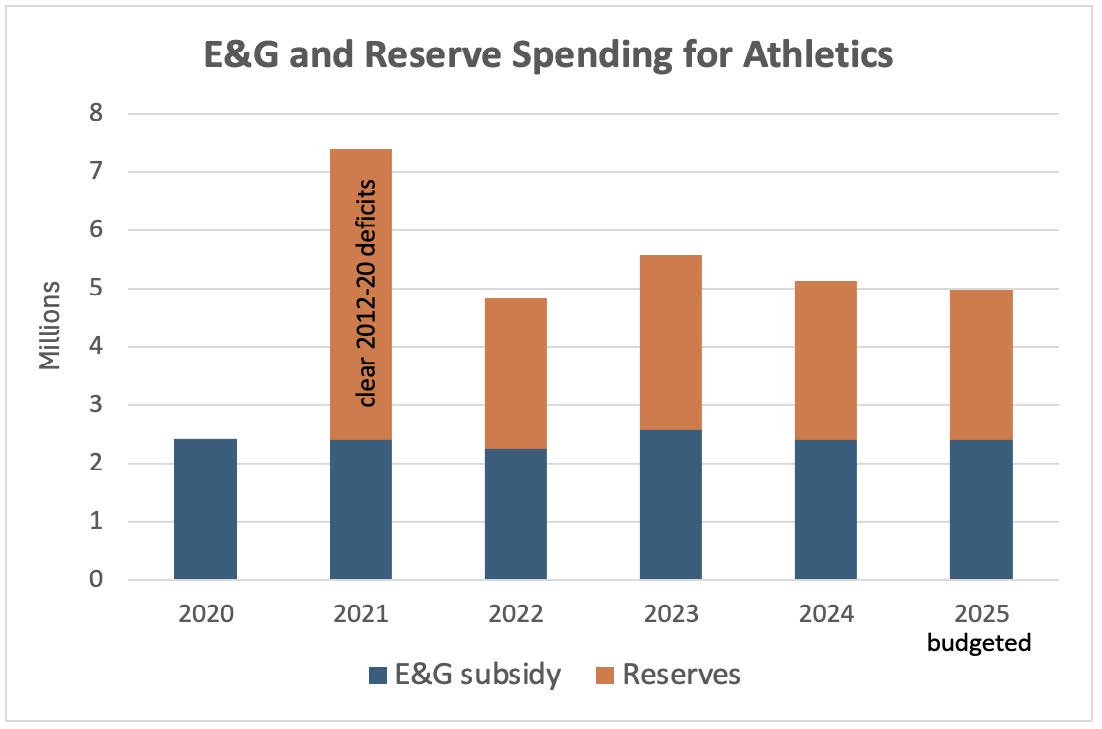

We know that University leadership does not really think of the institution that way either. At the end of FY 2021, the Board was presented with negative cash balances for various auxiliary enterprises outside of E&G, including Athletics and University Place Hotel. The Board authorized the use of E&G reserves to cover these balances. In the case of Athletics, reserves have been used every year since then to cover revenue shortfalls, in addition to a separate E&G subsidy with a longer history.

To make such observations is not to enter into a debate about the value of Athletics to the University’s mission. It is rather to shine a light on the financial priorities of the University leadership and to wonder whether the Board is not being selective in the exercise of its fiduciary responsibilities, so often invoked in its communications to the campus community.

Conclusion

The financial narrative presented by PSU’s leadership appears to be at odds with the institution’s overall fiscal health, as relayed in both the Bunsis Report and PSU’s Financial Profile. The University’s solid financial position is evidenced by increasing net assets, reserves exceeding debt, and a Primary Reserve Ratio above the Board’s aspirational level. Yet, the administration continues to push a crisis narrative to justify austerity measures and faculty layoffs.

The discrepancy between the University-wide financial health and the purported E&G fund crisis raises questions about the institution’s financial management and priorities. The selective use of fund accounting to paint a picture of financial distress, while simultaneously approving major capital projects and subsidizing auxiliary enterprises, suggests a misalignment between the administration’s actions and their stated concerns.

Ultimately, the choices made by PSU’s leadership reflect their priorities. The campus community deserves transparency, strategic decision-making, and a commitment to the institution’s educational mission. It’s time for the Board and administration to align their financial decisions with the University’s true fiscal reality and prioritize the core academic functions that define PSU’s purpose and value.